Forget voting: Here’s what Wall Street, betting markets, and economic models are saying about tomorrow’s election – The Boston Globe

Whether these signs have any relation to the final selection remains to be seen. But with one day to go, here are some important financial and economic facts.

Donald Trump’s media company operates on the Social Reality platform and trades on the Nasdaq under the symbol DJT. The stock is seen as a proxy for how investors view Trump’s chances in the election – as there is little financial reason to buy shares in a loss-making company with dwindling revenue.

The stock began rising steadily in late September, and rose as polls suggested the race was swinging Republican. Shares in Trump Media gained nearly 50 percent in the three trading days between Oct. 24 and Oct. 29. But not for long. The stock has 22 percent on Wednesday, 12 percent on Thursday, and 14 percent on Friday.

Trump Media stock was up 11 percent in mid-afternoon trading on Monday.

Some analysts have attributed the recent decline to a reaction to Trump’s insults and threats at Madison Square Garden, others to short sellers profiting from driving down stock prices and targeting companies with high quality. Either way, the uncertainty underscored that the company’s main asset is Trump and his political prospects.

Short positions in Trump Media stock doubled between July and mid-September to nearly 14 million shares, according to Nasdaq. In the latest update on October 15, short positions accounted for about 13 million shares, about a third of the daily total.

If Trump loses, Matthew Tuttle, CEO of Tuttle Capital Management, told Fortune magazine, the stock price of his media company “eventually goes to zero.”

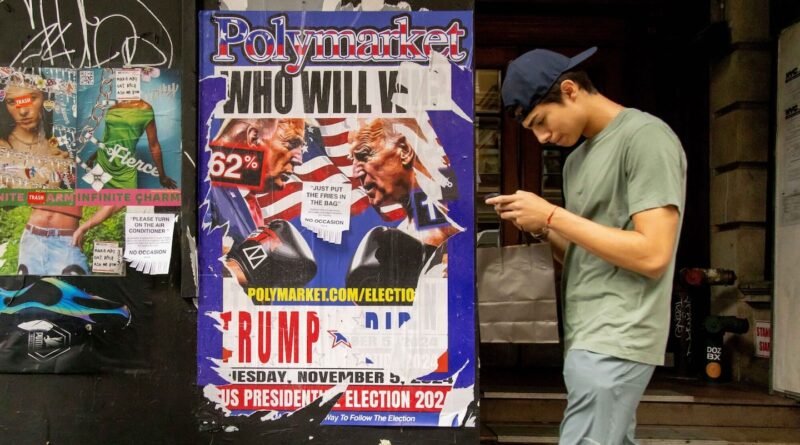

Betting or prediction markets measure odds based on how much investors — that’s right, traders — are willing to pay for contracts that back voters. For example, if customers pay 60 cents for a contract that pays $1 if Trump wins, they believe that his chances of winning are 60 percent. (They get zip if Trump loses.)

The odds have favored Trump in recent weeks, but Vice President Kamala Harris has closed the gap — especially after a poll released Sunday found her leading in Iowa. In the Kalshi betting market, Trump’s odds fell from 63 percent on Tuesday to 51 percent on Sunday, but rose to 55 percent on Monday morning. Polymarket, a cryptocurrency-based prediction platform, had slightly higher Trump odds.

Betting markets, however, are thinly traded and easily dominated by a few big bets. Again, the odds don’t pay off – as Bostonia can attest this season on the 20th anniversary of the Red Sox’s historic return to the American League Championship Series.

Ray Fair, an economics professor at Yale University, has developed a model that predicts the Democrat share of the popular vote based on a short list of political and economic factors, including unemployment, economic growth, and the growth of price.

The model, developed in 1978, often predicts results by a few percentage points. Its latest — and final — moment came Wednesday after the Commerce Department released economic growth and inflation data for the third quarter. The model predicted Harris’ vote share at 49.5 percent.

Brian Bethune, an economics professor at Boston College, noted that if you consider 1 or 2 percent going to third-party candidates, Fair’s model is tied to the race. Which is where we started.

It has long been a saying in politics that Election Day is the only election that matters. But with the stakes so high and the outcome so unclear, anxious viewers will be watching for signs – and hoping – they can find it.

Rob Gavin can be reached at rob.gavin@globe.com.

#Forget #voting #Heres #Wall #Street #betting #markets #economic #models #tomorrows #election #Boston #Globe